Investment in Energy Infrastructure

Due to its aging energy infrastructure and constant demand growth, massive investment in generation power plants and grids is required in the EU, but this is also true in many other countries as well. However, global investment in clean energy fell for the second year in a row to US$254 billion last year, with green investment in Europe crashing by 41 %. The drop casts a pall over a high- profile investor summit at the United Nations. The summit was supposed to build momentum for the shift to a clean energy economy—a transformation requiring global investment of some US$1 trillion a year by 2030. But investment in clean energy headed downward last year, according to the figures released at the summit by Bloomberg New Energy Finance (BNEF). It was the second year of declining investment in clean energy from a record US$318 billion in 2011. The sharp fall in investment in Europe was partly the result of declining costs for solar panels, bringing down the costs of rooftop solar. Even with the lower figures for clean energy investment, global solar installations grew by 20 % last year. But with big economies such as Germany, Italy, and France scaling back government support for new projects, clean energy investment fell from US$98 to US$58 billion in Europe, a drop of 41 %. Germany saw the biggest decline, from US$26.2 billion in 2012 to US$14.1 billion last year—the lowest since 2006. The UK, in contrast, saw a relatively modest decline from US$14.3 to US$13.1 billion.

The UN’s climate chief, Christiana Figures, urged global financial institutions to triple their investments in clean energy to reach the US$1 trillion figure needed to avoid a climate catastrophe. The objective is to persuade investors that it is in their financial interest to move now to limit their exposure to coal and oil. “There is study after study coming out saying: Beware we are invested in assets that are already and will soon be losing value,” she said. But with the latest figures from Bloomberg, Figures’ task became even more difficult. It appears that clean energy investment will have to grow fourfold—an even more ambitious target than was she had originally estimated.

In the specific case of Europe, over the next 12 years, 360 GW of new electricity capacity—50 % of current EU electricity generating capacity—needs to be built to replace aging power plants to meet the expected increase in demand. Since energy investments are long-term investments, today’s decisions will influence the energy mix for the next decades. The majority of investments in the energy system is long- term assets, sometimes requiring long lead times, and having lifetimes between 30 and 60 years, leading to significant lock-in effects. Any change to the system materializes only gradually. Current market structure and infrastructures can discourage new technology development, since infrastructure, market design, and grid management and development require adaptation and modernization, which represent additional costs which face resistance from the industry. For this reason, the investments that need to be carried out in the current energy infrastructure in several countries in order to satisfy their future expected demand of energy are enormous.14 It is expected that the EU should invest “€100 billion in transmission networks and €340 billion in distribution networks for reinforcement, asset replacements and new connections over the period 2001–2030” (EWEA report 2005).

Upgrading the European electric power network infrastructure at transmission and distribution level is perhaps the most fundamental step on the way to reaching the EU’s mandatory target to meet 20 % of their energy from renewable energy sources (the new target that is considered by the EU is 27 %), including increasing the share of renewable electricity from 15 to 34 % by 2020. Equally, renewable energy—together with security of supply, energy independence, and developing the internal market—has become a significant driver for expanding, moderniz- ing, and interconnecting the European electricity networks. Better interconnected networks bring significant benefits for dispersed renewable power by aggregat- ing (bringing together) dispersed (uncorrelated) generation leading to continental smoothing, improved predictability, and a higher contribution from wind power capacity to peak demand.

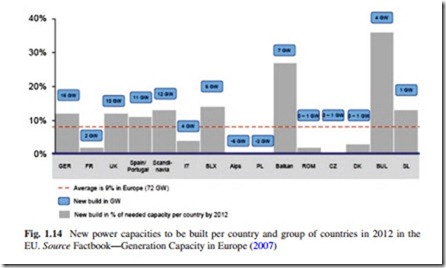

However, EU must act urgently because it takes several years to make productive the investments that are needed to update the current aging energy infrastructure of the region. The new power capacities to be built in 2012 in order to satisfy the foreseen increase in electricity demand are shown in Fig. 1.14.

From Fig. 1.14, the following can be stated: The country with the high- est power capacity to be built in 2012 is Germany with 16 GW, followed by the Scandinavian countries with 12 GW, Spain and Portugal with 11 GW, UK with 10 GW, and the Balkan subregion with 7 GW.

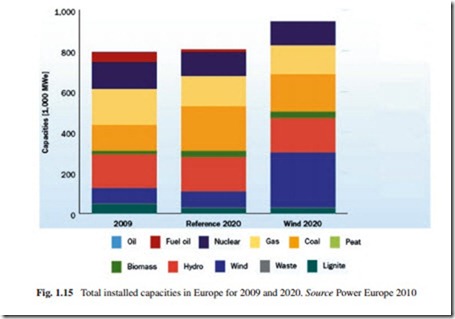

The total installed capacities in two possible scenarios can be seen in Fig. 1.15. The reference scenario gives a total installed capacity of 775 GW in 2020, with a total demand of 3,754 TWh per year. In comparison, the wind scenario shows a slightly higher demand, 3,859 TWh per year, and a significantly higher total

capacity with 908 GW. As a result, conventional capacities whose total volumes are therefore lower in the wind scenario than in the reference scenario are replaced, especially coal and gas technologies. The detailed mix of the total installed capacities for both scenarios can be seen in Fig. 1.15.

Finally, it is important to highlight the following: While there has been good progress in the EU with the publication of the European Network of Transmission System Operators for Electricity Ten-year Network Development Plan and the EU Blueprint for an Integrated European Energy Network, there has been little progress on the ground with only a few projects in development and even fewer of these involving cross-border cooperation. In the area of regulatory harmonization and streamlining, there has been almost no progress to simplify permitting processes especially on a regional level. Individual EU member states also lack credible proposals for addressing this area. Without this, new infrastructure development in the EU, as well as greater market integration and capacity expansion, is likely to be held back (PIK 2011).

An analysis of Europe’s power plants between 2000 and 2011 reveals two major trends. Firstly, the electricity sector is relying less and less on coal, nuclear energy, and oil when making its investment decisions, according to the EWEA. For each of these power generating alternatives, more capacities were removed from the grid than new ones were installed. The net change in capacities installed in the EU totaled minus 10 GW in the case of coal-fired power plant, minus 14 GW in the case of nuclear energy, and minus 14 GW for oil-based electricity generation. Secondly, the trend is moving toward renewable energy sources of electricity generation and natural gas. The net capacity growth in the case of natural gas totaled

The trend toward the use of renewable energy sources for electricity genera- tion in Europe is the following. In 2011, renewable energy sources contributed 32 GW or 71 % of newly installed power plant capacity. With a share of 66 %, solar PV lies well ahead of wind power (30 %), hydropower (2 %), SCP, and biomass (each 1 %). And the future of European power generation also belongs mainly to renewables. This is ensured by the broad political (and thus also financial) support in Europe, not least in the most significant country by volume, Germany, where the government and the opposition are uncommonly united in steering “the new energy policy” toward renewables (Auer 2013).

Regardless of the effort carried out up to now by many countries, in particular by the European industrialized countries, in the development and use of renew- able energy sources for electricity generation, the use of these technologies has not substantially modified, up to now, the energy balance of these countries. Fossil fuel stay as the main energy sources for electricity generation for many of them, particularly coal and natural gas, and it is expected that this situation will not change drastically before 2050. According to conservative projections, new technologies will begin to influence the energy balance of the different countries, particularly in Europe, around 2050. To achieve this long-term goal, European government should adopt an appropriate energy policy and strategy that guarantee a successful development of these new technologies.