The Situation of the Wind Power Sector in the EU

Wind power is the single largest non-hydro renewable power generation source in the EU. Since 2000, wind power capacity has grown from 12,800 to 96,443 MW in 2012 and to 117,300 MW in 2013: 110.7 GW onshore and 6.6 GW offshore; this represents an increase of 9.1-fold in the past 14 years and 13 % of the total

energy capacity installed in the EU. In 2013, a total of 1,159 MW of new wind power capacity (worth between €13 and €18 billion) was installed in the EU-28, a decrease of 8 % compared to 2012 installations (Wind in Power 2014).

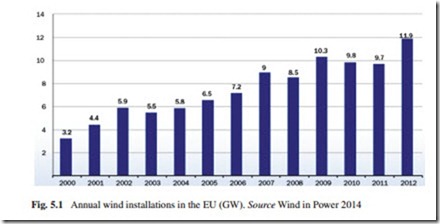

During the period 1997–2013, wind power capacity has grown more than esti- mated: In the 1997 White Paper (EC 1997), wind power capacity was estimated to be 40 GW in 2010, but reached that figure in 2005; in 2013, wind capacity reached 117,300 MW, around 192 % more than the capacity planned for 2010. During the period 2000–2012, the wind power capacity increased 271 %. In 2009, wind power installations accounted for 39 % of new power-generating capacity installations in the EU (EWEA 2010). In 2012, the new wind power installations represented 26.5 % of all new power capacity installed, 12.5 % lower than in 2009, but 5.1 % higher than in 2011, and 2012 is the year with the highest wind power plants installed in the EU during the period 2000–2012 (see Fig. 5.1).

In 2011, wind power generation in EU totaled 181.739 TWh, representing about 4 % of the total net electricity generation. Germany and Spain are the largest wind power producers, together accounting for 63 % of installed capacity. In Denmark, wind power accounted for almost 20 % of the net electricity generation, and in Spain and Portugal, this figure was 10.6 and 12.8 %, respectively. Despite the decrease in annual wind power installations, global installed wind power capacity increased by 24.1 % during the year, and now stands at 197 GW. For most other sectors that have not become accustomed to growth rates of 30 % or more, this would represent a major achievement. The main markets driving growth continue to be Asia and Europe, which installed 21.5 and 9.9 GW, respectively, in 2010. However, emerging markets in Latin America are beginning to take off, led by Brazil and Mexico. In cumulative terms, the Latin America and Caribbean market grew by more than 53 % during 2010. The outlook for 2011 is more optimistic, with an overall investment in wind power up by 31 % or US$96 billion, according to Bloomberg New Energy Finance (BNEF). This investment gives rise to some optimism going forward, as it is likely to translate into actual projects in 2011 and 2012. It is notable that 38 % of this total investment was accounted for by China and by large European offshore wind farms (GWEC 2011).

According to EWEA 2011, investment in EU wind farms in 2010 was €12.7 billion. The onshore wind power sector attracted €10.1 billion during 2010 (79.5 %), while the offshore wind power sector accounted for around €2.6 bil- lion (20.5 %). The IEA expects 5,087 GW of electricity-generating capacity to be installed worldwide in the period 2005–2030, requiring investments of US$5.2 trillion in power generation, US$1.8 trillion in transmission grids, and US$4.2 trillion in distribution grids. The IEA expects also 862 GW of this total to be built in the EU, requiring investments of US$925 billion in new generation, US$137 billion in transmission, and US$429 billion in distribution grids.

European electricity generation is projected to increase at an average annual rate of 1.8 % between 2000 and 2010, 1.3 % in the decade 2010–2020, and 0.8 % in the decade up to 2030. If the reference scenario is reached, wind power pro- duction will increase to 477 TWh in 2020 and 935 TWh in 2030. The EC’s base- line scenario assumes an increase in electricity demand of 33 % between 2005 and 2030 (4,408 TWh). Assuming that EU electricity demand develops as projected by the EC, wind power’s share of EU electricity consumption will reach 11.7 % in 2020 and 21.2 % in 2030 (Zervos and Kjaer 2008).

In another record year for wind power, at least 44 countries added a combined 45 GW of capacity (more than any other renewable technology), increasing the global total by 19 % to 283 GW. The USA was the leading market, but China remains the leader for total wind power installed capacity. Wind power is expanding to new markets, aided by falling prices. Almost 1.3 GW of capacity was added offshore (mostly in Northern Europe), bringing the total to 5.4 GW in 13 countries. The wind industry has been challenged by downward pressure on prices, combined with increased competition among turbine manufacturers, competition with low-cost gas in some markets, and reductions in policy support driven by economic austerity (REN 21 2013).

Upgrading the European network infrastructure at the transmission and distribution level is vital for the emerging single electricity market in Europe and is a fundamental step on the way to the large-scale integration of wind power. Better interconnected networks help aggregating dispersed (uncorrelated) generation leading to continental smoothing, improving the forecasting ability, and increasing the capacity credit of wind power. Considering the 2030 wind and transmission scenario (279.6 GW of installed wind capacity in that year), different studies estimate a yearly reduction of €1,500 million of the total operational costs of power generation as a result of electrical grid interconnection upgrades. European studies, like TradeWind and EWIS, have quantified the huge benefits of increasing interconnection capacities for all grid users and have identified specific trans- mission corridors to facilitate the implementation of large-scale wind power in Europe. However, significant barriers to expansion of the current network toward a truly pan-European grid exist, including public opposition to new power lines (causing very long lead times), high investment costs and financing needs, and the absence of proper cost allocation and recovery methods for transmission lines serving more than just the national interest of a single country.

The control methods and backup available for dealing with variable demand and supply that are already in place are more than adequate for dealing with wind power supplying up to 20 % of electricity demand, depending on the specific system and geographical distribution. For higher penetration levels, changes may be needed in power systems and the way they are operated to accommodate more wind energy.

Since wind energy is a technology of variable output, it needs to be considered as just one aspect of a variable dynamic electricity system. At modest penetration levels, the variability of wind is dwarfed by the normal variations of the load. The variability of wind energy needs to be examined in wider context of the power system, rather than at the individual wind farm or the wind turbine level. The wind does not blow continuously at any particular site, but there is little overall impact if the wind stops blowing in a certain area, as it is always blowing elsewhere. This lack of correlation means that at the system level, wind can be harnessed to pro- vide stable output regardless of the fact that wind is not available all the time on any particular site. So in terms of overall power supply, it is largely irrelevant to consider the curve when a wind power plant produces zero power for a time, due to local wind conditions. Moreover, until wind becomes a significant producer (supplying around 10 % of electricity demand), there is a negligible impact on net load variability.

The impacts of wind power in the electricity system depend to a large extent on the following:

• Level of wind power penetration;

• Grid size;

• Generation mix of electricity in the system.

Wind energy penetration at low to moderate levels is a matter of cost, as demonstrated by various national and regional integration studies. And the integration costs related to the impacts listed above are fairly modest. For low penetration levels of wind power in a system, it operation will hardly be affected.

The established control methods and system reserves available for dealing with variable demand and supply are more than adequate for dealing with the additional variability at wind energy penetration levels of up to around 20 %, depending on the nature of a specific system. For higher penetration levels, some changes in the system and their method of operation may be required to accommodate the further integration of wind energy.