Italy

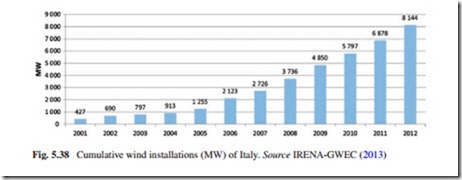

At the end of 2009, Italy was host to 4,850 MW of wind energy generation capacity, an increase of more than 1,100 MW compared to 2008 (see Fig. 5.38). The regions which added the most new wind farm capacity were Sicily, Puglia, and Calabria, followed by Campania and Sardinia. Some wind power developments are also taking place in Central and Northern Italy, in regions such as Liguria, Piedmont, Veneto, Emilia Romagna, and Tuscany. As usual, the largest development in 2011 took place in Southern regions, particularly in Apulia, Calabria, Campania, Sardinia, and Sicily. The five regions with the highest wind capacities can therefore be ranked as follows: Sicily (1,676 MW), Apulia (1,365 MW), Campania (1,062 MW), Sardinia (947 MW), and Calabria (772 MW) (IEA Wind 2010 Annual Report).

According to Wind Power data, at the end of 2013, the wind energy generation capacity increased up to 8,551 MW; this represents an increase of 76.3 % with respect to 2009 and 4.9 % with respect to 2012. Today, the country has installed 357 wind farms in different locations. The country has the fourth largest installed wind capacity in the EU (EWEA 2013) and has 2.81 % of the world total wind energy-installed capacity in 2011.

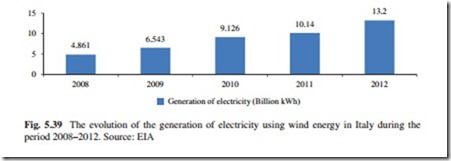

The Italian Wind Energy Association (ANEV) estimates that more than 6 TWh of electricity (6.543 TW) was produced by wind energy in 2009, bearing in mind that around 700 MW of new capacity came online only in the second half of the year. In 2012, the generation of electricity using wind power reached 13.200 TW; this represents an increase of 101.7 % with respect to 2009.

The global financial crisis is affecting Italy’s wind energy sector, not in terms of production or employment, but in terms of tightening project finance. Consequently, some wind energy project funding has slowed down, and this is expected to continue through 2010s.

The 1999 Bersani Decree provided for the gradual liberalization of the Italian electricity market and encouraged generation from renewable sources by intro- ducing priority grid access to renewable electricity, as well as a renewable energy quota system. This requires power producers and importers to produce a cer- tain percentage of electricity from renewable energyources. Green certificates are used to fulfill this obligation, starting from 2 % and gradually increasing. In January 2002, Italy implemented a new support mechanism for renewable energy sources based on green certificates, to replace the former regime and complement the quota system. The following changes were implemented in the green certificate system:

• Duration: Renewable energy plants with a capacity of more than 1 MW and coming into operation after December 31, 2007, are entitled to receive green certificates for a period of 15 years instead of 12 years;

• Characteristics of green certificates: From 2008, green certificates have a

value of 1 MWh. For calculating the number of green certificates, the net electricity output of each plant is multiplied with a parameter, depending on the technology. For onshore wind turbines, this parameter is 1.0; for offshore wind turbines, it is 1.1;

• Value and price: Starting from 2008, green certificates issued by the national

TSO (GSE) are sold at a price equal to the difference between a reference value, which is €180 per MWh for the first year, and the annual average price for electricity sale.

The reference price may be altered every three years by the GSE to ensure a remuneration that is adequate. Another innovation was introduced in 2009, which moved the obligation to source a certain amount of energy from renewable energy sources (or buy green certificates) from the producer to the distributor by 2012. For renewable energy generators, this will mean that they will trade green certificates with distributors rather than producers. However, further implementation measures concerning the operational details of these changes are still outstanding.

From January 1, 2013, the quota system will be replaced by a feed-in system for schemes under a given threshold and a tendering scheme for new power plants (except biomass) with a capacity above the threshold. The threshold is differentiated by renewable energy sources. Details of the implementation will be elaborated in upcoming Ministerial Decrees. GSE must buy all certificates that exceed the annual demand. Legislative Decree 28/2011 rules that for renewable energy installation starting operation after December 31, 2012, the feed-in premium sys- tem in place over 2011–2012 will be replaced by a FiT scheme. The tariff would include the price at which GSE purchased the electricity generated by renewable energy sources from the producers. The duration of the support will be equal to the average lifetime of the technology. This incentive is to be granted under private contracts with the national transmission system operator. The incentive will remain constant throughout the support period. The 2011 Decree sets a goal of 23,000 MW of renewable capacity installed by 2016 and is likely to produce major changes in the national support policy in renewable energy (IRENA-GWEC 2013). According to ANEV, a total of 16,200 MW of wind energy could be installed by 2020, producing 27 TWh of electricity, and reaching approximately 50 % of the 2020 objective.

Despite of the measures already adopted, the Italian wind energy market continues to be hampered by ambiguities in the current energy policy design and a delay in the introduction of measures needed to develop the energy industry, such as guidelines and details on the regional breakdown of the country’s overall renew- able energy quota.

In addition, the Italian electricity system suffers from an inadequate grid infra- structure, which leads to frequent curtailment of wind power production to man- age grid congestion. The grid problem concerns all projects in Campania, Apulia, and Basilicata and some projects in Sardinia. These problems occur systematically due to the low capacity of the grid, especially on old-fashioned 150 kV lines that are incapable of dispatching all the power produced by the wind farms. In 2009, some wind farms operated at 30 % less than their normal capacity over the course of the year due to inadequate grids. In some cases, wind farms were limited by over 70 %, and in other cases, some wind farms were shut down completely (IRENA-GWEC 2013).

Italy’s grid issues need urgent attention, and the sector is waiting for a strong structural response to adapt the grid to accommodate both the current installed capacity and the planned wind energy capacity increase. In addition, wind opera- tors must be adequately compensated for such curtailment. In addition to grid issues, Italy also suffers from administrative constraints such as complex authorization procedures and high connection costs.

Potential sites outside the traditional areas in the Southern Italian mainland are more and more at stake. However, the main barriers to the development of the wind energy sector remain the regional authorization hurdles, local acceptance, and grid connection difficulties. Without any doubt, in some places, the strength of the wind can produce a good quantity of energy, but the use of this type of resource requests the installation of high trestles, in which environmental and naturalistic associations are strongly rejected.

Italy is one of the two EU member states to indicate in its NREAP that it will not meet its 17 % renewable target domestically, forecasting a shortfall of 0.85 % in 2020. Consequently, the Italian action plan intends to meet some 27 % of the country’s electricity consumption with renewables by 2020, with onshore and offshore wind power providing just over 5 % of total electricity consumption, requiring a cumulative capacity of just below 13 GW, of which 680 MW is from offshore wind installations. The onshore target is significantly (3–5 GW) lower than what EWEA considers the Italian market can deliver, and indeed, the action plan suggests an annual build-out rate greatly inferior to that which the Italian market has delivered for the past four consecutive years.

However, the NREAP highlights delays in the authorization procedures for new renewable power plants and grid development without offering a solution to end them. Moreover, the document announces revisions of the support scheme may result in an undermining of investor confidence. These weaknesses in the plan could result in an investor caution unless improved with the introduction of future policies.

Table 5.24 includes the Italian wind energy target for 2020. Summing up, the following can be stated:

• The green certificate system was an efficient support mechanism leading to strong growth in the wind energy market;

• Italy has the highest average expenditure for supporting wind power and small hydroelectric power plants in the EU (Rathmann et al. 2009). Although Italy’s priority is to diversify its energy supply and to lower its dependency on imported gas in the electricity sector, the costs of the support policy might not be sustainable in the future;

• The country’s generous support scheme has, however, attracted investors despite long administrative procedures and grid constraints;

• The regions play an important role in the deployment of renewable energy technology. Up until now, developments have been mainly concentrated in the South of the country, causing grid overloads.

The national policy for renewables operates through a complex set of incentives which range from indirect regulatory support measures, such as FiTs and fiscal incentives, to market-based mechanisms, such as quota obligations and tradable green certificates. The incentive schemes are not adjusted in line with the technology learning curve. The support for renewable energy is not within the range of production costs from other technologies. The high support levels have increased the number of investors involved in renewable energy production and led to the successful growth of onshore wind power and solar PV (IRENA-GWEC 2013).

Based on financial commitments of investors to connect wind farms to the grid, the government foresees continuing development of installed wind capacity. According to the TSO, total wind capacity could reach 9,600 MW by 2013–2014. The development of any offshore wind farms is still uncertain, at least in the next few years. If these expectations were fulfilled, however, most of the 2020 target capacity set by the government’s plan on June 30, 2010 (12,680 MW, of which only 680 MW is offshore) should come on line already by 2015.

Generation of Electricity Using Wind Energy

The evolution of the generation of electricity using wind energy in Italy during the period 2008–2012 is shown in Fig. 5.39.

According to Fig. 5.39, the generation of electricity using wind energy as fuel in Italy during the period 2008–2012 increased 171.5 %. On the basis of the measures already adopted by the government, it is expected that the generation of electricity using wind power in the country will continue increasing during the coming years.

Finally, it is important to highlight the following: According to IEA Wind (2010) Annual report, capital costs of wind farms have generally been higher in Italy than in other EU countries, as more wind farms are built on rather remote hill or mountain sites, which increases costs of transportation, installation, grid connection, and operation. Lengthy and uncertain permitting procedures, not to men- tion negotiations for getting financing from banks, etc., also bring about additional costs. The overall capital cost of typical Italian wind farms could be split as fol- lows: between 10 and 20 % for project development (wind surveys, plant design, permitting, etc.); between 60 and 70 % for wind turbines (including erection and commissioning); and between 20 and 25 % for civil and electrical infrastructures (grid-connecting lines, etc.).

As stated in the IEA (Wind 2010) Annual report, the specific capital cost of a typical land-based wind farm of medium capacity (20 MW) at a site of medium complexity could be put at about €1,750 per kW, within a range from €1,500 per kW to €2,000 per kW. Assuming the average capital cost, an annual operation and maintenance cost growing over the plant’s 20-year lifetime from 1 to 4 % of capital cost, and 1,800 h per year of equivalent full-capacity operation, the levelized energy cost would turn out about €127 and €138 per MWh with discount rates of 5 and 7 %, respectively.

Small wind plants (up to 200 kW) have higher specific capital costs, which grow substantially as size decreases, and they can tap less wind power because of their lower hub height. Considering also the uncertainty of wind estimates (wind-meas- uring campaigns are too costly for small plants), in Italy, it would be cautious to assume no more than 1,500 h per year of full-capacity operation. Unit energy costs vary over a wide range, but are, however, higher than for large machines. That is why a special FiT has been made available to prime deployment of the small wind sector.