The Future of the European Solar Photovoltaic Market

According to Masson et al. (2013), the European solar PV market peaked in 2011 with more than 22 GW installed. Such a high level was not sustainable, and the market went down to 17.7 GW in 2012. The 2013 market declined further to nearly 11 GW, which is the lowest level since 2009 in Europe. While the market slowdown in Germany and Italy was predictable and expected, the stability of the rest of Europe (considered as a whole) should not be misinterpreted. Each year, some markets boomed before experiencing a bust in the following years, and the market was shored up by different countries every year. The picture is clearer when looking at the countries that installed close to or at least 1 GW each year (outside of the top two countries); in 2011, Belgium, France, and the UK; in 2012, France again, the UK, Greece and Bulgaria; in 2013, Italy and Greece again, and Romania.

The instability of solar PV markets in Europe leads to the important conclu- sion, for market forecasts in Europe that, with the exception of a comparably soft landing on the market in Germany, no country that experienced a serious solar PV boom once has so far succeeded in restoring market confidence. On the contrary, policy makers seem to have ensured that in these countries, solar PV would not be allowed to reach the same market levels reached previously. This was the case in Spain, Czech Republic, Slovakia, Bulgaria, and most probably in Belgium and Italy. The number of markets in Europe, where solar PV has not developed yet, remains limited, and considering past experience, a further overall market decline could emerge if particular countries replicate the pattern of boom and bust seen elsewhere in Europe.

Overall, the future of the European solar PV market is uncertain for the coming years. The drastic decrease of some FiT programs will push some markets down in 2014, with a limited number of emerging markets in Europe that could offset any major decline. Given these new conditions, the short-term prospects for the European solar PV markets are stable in the best case and could even decline.

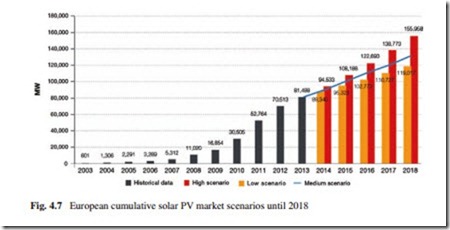

It is foreseeable that in 2014, the EU will see a new market decline in the region that could limit the amount of new connections to around 8–9 GW, while competitive solar PV in several key countries could help maintain the market at around 10–12 GW in the second part of the decade. In this case, the total installed solar PV capacity in Europe could reach between 119 and 156 GW in 2018, starting from 81.5 GW at the end of 2013. In the best case, the 100 GW mark could be reached by 2015 in Europe.

The countries where solar PV has not developed until now will be interesting to follow in the coming years, because of their untapped potential, but also for the unique opportunity to witness a different market development than what was experienced until now in most European countries. The history of solar PV proves that a stable policy framework using support schemes in a sustainable way increases market confidence. Poland, Croatia, Hungary, and to a lesser extent Ireland could develop in the coming years in various forms. Among the “old” markets, the rebirth of France, at the heart of the European grid, should be carefully followed and encouraged in a way that suits the specifics of this country, particularly after the decision of the government to reduce the participation of nuclear energy in the energy mix of the country to 50 % in the coming years. In a similar way, solar PV will not redevelop in Spain unless solutions can be found to the relative isolation of the country from a grid perspective.

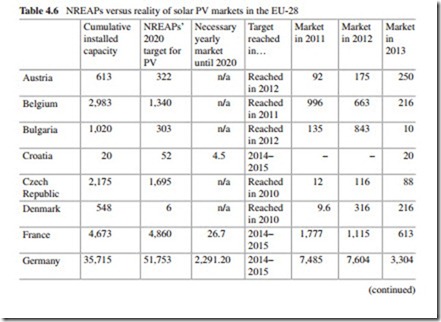

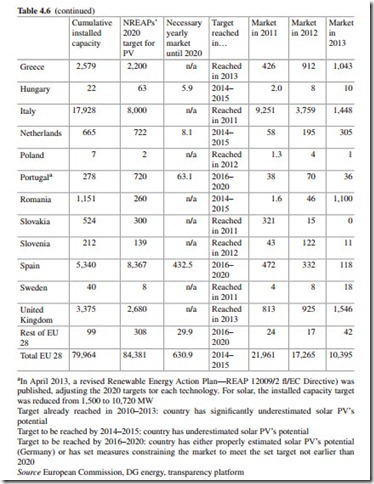

Figure 4.7 shows the different European cumulative solar PV market scenarios until 2018, and Table 4.6 shows how the NREAPs are implemented in each EU-28 states.

It is expected that the solar PV penetration in Europe in 2030 could be between 10 and 15 % of electricity demand. Considering the current trends and without major changes of policy, a share between 7 and 11 % of solar PV in the European electricity demand appears realistic. The potential for 2020 is roughly twice as high as the levels foreseen in the NREAPs, pushing toward at least 150 GW

compared to 84 GW. In fact, with 81.5 GW installed by the end of 2013, the Europewide NREAP target of 84 GW will already be reached in 2014.

The situation in the use of solar power for the generation of electricity in a selected group of European countries is briefly described in the following paragraphs.