Main Barriers to the Massive Use of Solar Power Technology for the Generation of Electricity

There are several barriers to the massive use of solar power technology for the generation of electricity. The main barriers are, among others, the following:

• Land Use: Solar radiation has a low energy density, and requires a relatively large area to collect an appreciable amount of energy. Typical solar power plant designs require about 5 acres per megawatt of generating capacity. For example, a 200-MW solar thermal trough plant would require about 1,000 acres of land. Likewise, a 30-MW thin film solar PV array would require about 168 acres. While the construction of large solar power plants is technologically feasible, their size requires that land-use issues should be considered. However, these concerns may be mitigated to some extent since large solar power plants tend to be located in remote, unpopulated areas, and for small distributed solar facilities they are typically located on rooftops of existing buildings;

• Water use: The need for water depends on the solar technology selected. Solar thermal electric technologies, such as central receiver and parabolic trough designs require a considerable amount of water for cooling. While the quantity of water needed per acre of use is similar to or less than that needed for irrigated agriculture, dependability of the water supply is an important consideration in the sunny, dry areas of the state that are favored for large-scale solar power plants. Solar power plants based on solar PV and dish–Stirling engine designs, as well as small-scale PV and solar thermal installations, do not require water. These systems actually reduce water consumption by offsetting energy production from conventional generators, which do consume water;

• Availability of transmission: To transport the power produced by a solar power

plant to urban load centers, adequate transmission is required. Intermittent resources such as wind and solar can pose unique problems in transmission planning and in efficient utilization of transmission infrastructure, resulting in higher transmission costs, increased congestion, and even generation curtailments when adequate transmission capacity is not available. Due to potential transmission constraints, solar project developers will need to evaluate the economic trade-off of locating where the resource is best versus locating nearer to loads where transmission constraints are less likely. Because solar and wind generation generally occurs at different times (solar during the day and wind generation at night), combining solar power plants with wind farms has the potential to result in fuller utilization of transmission capacity and improved matching of generation to utility loading, including peak loading conditions;

• Lack of government policy supporting the use of solar power: This includes

the lack of policies and regulations supporting development of solar technology;

• Lack of information dissemination and consumer awareness about solar energy;

• High cost of solar technologies compared with conventional energy;

• Difficulty overcoming established energy systems: This includes difficulty introducing innovative energy systems, particularly for distributed generation such as solar PV, because of technological lock-in, electricity markets designed for centralized power plants, and market control by established generators;

• Inadequate financing options for solar energy projects;

• Inadequate workforce skills and training: This includes lack in the workforce of adequate scientific, technical, and manufacturing skills required for solar energy development; lack of reliable installation, maintenance, and inspection services; and failure of the educational system to provide adequate training in solar energy technologies;

• Lack of stakeholder/community participation in solar energy choices;

• Strong dependency of the weather situation;

• Irregularity of the supply of energy at the level requested in a given moment;

• High initial up-front cost;

• Lack of credibility: Need credible endorsements of solar PV to instill consumer confidence; implicit endorsements include utility solar PV programs and government tax credits.

Summing up the following can be stated: With at least 38.4 GW of newly installed solar PV capacity worldwide and a global cumulative installed capacity of 138.9 GW, 2013 was another historic year for solar PV technology. Compared to the two previous years, where installed capacity hovered only slightly above 30 GW annually, the solar PV market progressed remarkably in 2013. Despite this, the global solar PV market is at a turning point, which will have profound implications in the future. For the first time in more than a decade, the European solar PV market was no longer the top regional solar PV market in the world. Asia surpassed Europe in a dramatic way, representing around 56 % of the world solar PV market in 2013. This Asian progress occurred in parallel with the relative decline in Europe already observed in 2012. Vigorous growth in non-European markets kept global solar PV development on an upward trajectory and largely compensated for the European slowdown. The main elements to be highlighted are the following:

• At least 38.4 GW of solar PV systems were installed globally in 2013, up from 30 GW in 2012; solar PV remains, after hydro and wind power, the third most important renewable energy source in terms of global installed capacity;

• Almost 11 GW of solar PV capacity was connected to the grid in Europe in

2013, compared to 17.7 GW in 2012 and more than 22.4 GW in 2011;

• For the first time since 2003, Europe lost its leadership in Asia in terms of new solar PV installations;

• China was the top market in 2013 with 11.8 GW, of which 500 MW represents off-grid systems. Statistics released in May 2014 show that the country may have installed an additional 1.1 GW on top of the 11.8 GW estimated by the EPIA. Since it is unsure whether these installations were connected to the grid EPIA did not take them into account. China was followed by Japan with 6.9 GW and the USA with 4.8 GW;

• Germany was the top European market with 3.3 GW. Several other European markets exceeded the one GW mark: the UK (1.5 GW), Italy (1.4 GW), Romania (1.1 GW), and Greece (1.04 GW);

• Several European markets that performed well in the past went down in 2013, a consequence of political decisions to reduce solar PV incentives: Belgian installations went from 600 to 215 MW, French went from 1,115 to 613 MW, and Danish went down from 300 to around 200 MW;

• Aside from the significant decline in Germany and Italy, the size of the remaining European solar PV market was stable, with around 6 GW per year in the last three years;

• Outside Europe, several markets continued to grow at a reasonable pace: India

with 1,115 MW, Korea with 442 MW, Thailand with 317 MW, Canada with 444 MW, and many others (Masson et al. 2013).

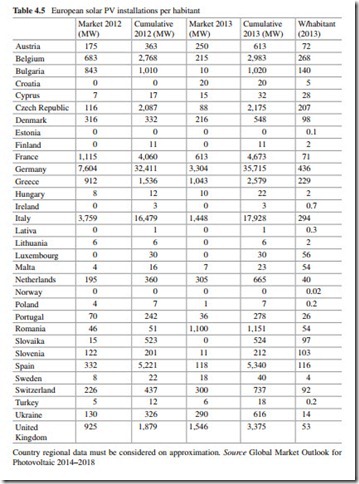

Finally, it is important to highlight the following: Germany is the country within the EU with the highest solar PV watts per habitant followed by Italy, Belgium, and Greece (see Table 4.5).