Natural Gas

According to the IEO (2013) report, natural gas consumption in OECD Europe is expected to grow by 0.7 % per year on average, from 19.8 trillion cubic feet in 2010 (699.237 trillion m3) to 24.5 trillion cubic feet in 2040 (865.2175 trillion m3), the lowest growth rate over the period, both in the OECD region and in the world. The decline in the future demand of energy from coal and liquid fuels is expected to result in an increase in the natural gas share of OECD Europe’s total energy consumption, from about 25 % in 2010 to 27 % in 2040, an increase of 2 % for the whole period.

More than half of OECD Europe’s 4.7 trillion cubic feet (165.98 trillion m3) of growth in total natural gas consumption from 2010 to 2040 is expected to come from the electric power sector, at 2.7 trillion cubic feet (95.35 trillion m3). Although the amount of natural gas consumed in electric power production is expected to increase by an average of only 0.6 % per year from 2010 to 2020, it is expected to increase by 1.7 % per year from 2020 to 2040, as economies recover from the global recession that began in 2008 and still is affecting the whole European region.

Many governments in OECD Europe have made commitments to reduce green- house gas emissions and promote the development of clean energy. Natural gas potentially has two roles to play in reducing CO2 emissions: as a replacement for more carbon-intensive coal-fired generation plants and as backup for intermittent generation from renewable energy sources. According to the IEO (2013) report, there are many incentives for using natural gas more heavily in the electric power sector, but growth has been hampered by a lack of progress in regulatory reforms in OECD Europe that would make natural gas more competitive in electric power mar- kets. Such reforms would include measures to increase spot trading and make natural gas markets more flexible by making it easier for market participants to purchase and transmit gas supplies. Although OECD Europe is largely expected to continue pricing natural gas via long-term indexed contracts in the near term, some developments—such as a recently signed deal between Germany’s Wintershall and Norway’s Statoil—signal movement toward spot market pricing (Lanthemann 2012).

It is important to highlight that, presumably, the impact of such reforms, as well as the increased use of natural gas to reduce carbon dioxide emissions from elec- tric power generation, would occur for the most part after 2025. Additionally, recent actions by some European governments to reduce their reliance on nuclear power in the wake of the Fukushima Daiichi nuclear disaster will provide an additional boost to both natural gas and renewable energy use in electricity generation. In the IEO (2013) report, an increase of 1.7 % per year in natural gas consumption for power generation from 2020 to 2040 is higher than for any other energy source used in the sector.

The EU has been attempting to implement legislation that would ease third- party access to Europe’s natural gas transmission pipelines and thus allows independent operators access to existing infrastructure. The EC ratified its third energy package in 2009,6 and its stipulations were required to be passed into local law by 3 March 2011. The regulatory changes should increase spot trading and make natural gas markets more flexible by making it easier for market participants to purchase and transmit gas supplies. Because natural gas is less carbon-intensive than either coal or petroleum, it is a more environmentally attractive option and thus is likely to remain an important fuel for Europe’s electric power sector development in the long term.

According to the IEO (2013) report, the countries of non-OECD Europe and Eurasia relied on natural gas for 47.3 % of their primary energy needs in 2010— the second highest of any country, except the Middle East. Non-OECD Europe and Eurasia consumed a total of 21.8 trillion cubic feet (769.867 trillion m3) of natural gas in 2010, the most outside the OECD, and more than any other region in the world, except the OECD Americas. Russia accounted for 69 % of the regional total in 2010, consuming 15 trillion cubic feet (529.725 trillion m3). Overall natural gas consumption in non-OECD Europe and Eurasia is expected to grow at a relatively modest annual rate of 1 % from 2010 to 2040. The region’s natural gas consumption is expected to grow by an average of 1.3 % per year from 2020 to 2040, increasing by a total of 6.8 trillion cubic feet (240.142 trillion m3). The trend is especially pronounced outside Russia. In the other countries of non-OECD Europe and Eurasia, natural gas consumption is expected to grow by an average of 1.4 % per year from 2010 to 2040, with consumption for electricity generation, increasing by 2 % per year, from 1.8 trillion cubic feet (63.567 trillion m3) in 2010 to 3.3 trillion cubic feet (116.54 trillion m3) by 2040.

Natural gas is the largest component of the region’s primary energy consumption, representing more than 40 % of the total throughout the projection period. The industrial sector remains the largest consumer of natural gas in non-OECD Europe and Eurasia, accounting for approximately 40 % of total natural gas con- sumption in non-OECD (IEO 2011).

The current and future situation regarding the use of natural gas for electric- ity generation is the following: Up to 2035, natural-gas-fired electricity genera- tion is expected to increase by 2.1 % per year. Electricity generation from natural gas worldwide is expected to increase from 3.9 trillion kWh in 2007 to 6.8 trillion kWh in 2035, but the total amount of electricity generated from natural gas contin- ues to be less than one-half the total for coal, even in 2035.

It is important to highlight that natural-gas-fired combined-cycle technology is an attractive choice for new gas-fired power plants because of its fuel efficiency, operating flexibility (it can be brought online in minutes rather than the hours it takes for coal-fired and some other generating power plants), relatively short planning and construction times, relatively low greenhouse gas emissions to the atmosphere, and relatively low capital costs.

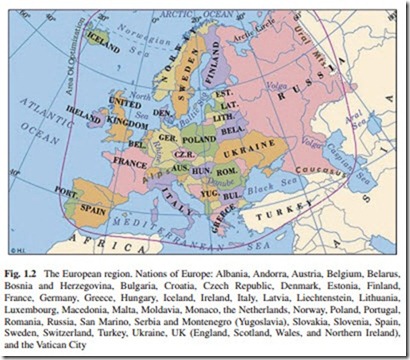

On the other hand, it is also important to consider the following reality during any consideration of the future energy balance in the European region (see Fig. 1.2). Europe is running out of indigenous energy resources in the form of fossil fuels at a time when a paradigm shift in energy prices is occurring. In 2013, the oil price was close to US$110 per barrel. The price of coal and natural gas is also expected to grow in the near future. Most observers agree that the era of cheap fossil fuels is

over and signs are emerging that competition for ownership of oil and natural gas is becoming fiercer and will intensify heavily in the coming years. The era of energy uncertainty has come. The wars against Iraq and Libya were fought, in addition to political factors, among other things, for the future control of important crude oil reserves located in these two countries.7 However, the current oil price of US$ 50 per barrel could change this situation, at least in the near future.