The Use of Solar Energy in the EU

Solar PV power is set to achieve the environmentalists’ holy grail of grid par- ity—the same cost price as fossil fuels—across the EU by 2017, according to a UN source. But, the Intergovernmental Panel on Climate Change (IPCC)’s recent report on renewable energies warned that “progress could be endangered by mar- ket uncertainty over the future of FiTs.” These tariffs are subsidies allowing fledgling renewable industries to compete with fossil fuels that receive up to ten times more state aid. It is expected that Spain, Italy, France, and Germany reach grid parity by 2015. Attaining parity across the EU as a whole would take five, maybe six years, and therefore, governments are urging not to change their energy policy in the solar sector.

Undoubtedly, solar PV markets in Europe and around the world continued to make rapid progress toward competitiveness in the electricity sector in 2013. Strong solar PV technology price decreases and electricity prices on the rise have helped drive momentum toward “dynamic grid parity”—when the savings in elec- tricity cost and/or the revenues generated by selling solar PV electricity on the market are equal to or higher than the long-term cost of installing and financing a solar PV system. Competitiveness is being reached progressively in some market segments of several EU countries (Masson et al. 2013).

In 2007, the EU’s Photovoltaic Technology Platform5 estimated that grid parity would only apply to most of Europe by 2020. The EPIA made the same prediction. Reaching grid parity will depend on the geographical situation, irradiation, and the price of electricity, said Eleni Despotou, secretary-general of EPIA. “We have recently done a study that shows that in Italy we can reach grid parity in two years’ time; in Germany in all market segments by 2017; in Spain in 2016.”

But while the solar PV industry’s rapid growth has surprised many observers, cuts to national subsidies have also startled the solar PV markets, leading some companies to look eastward for opportunities in emerging solar PV markets. The EU’s Climate Action Commissioner considers that EU nations should remember the Commission’s 2020 targets for renewables when taking such decisions.

According to Resch (2006), there are four primary applications for solar PV power systems:

• Off-grid domestic systems, which provide power in isolated remote areas;

• Grid-connected distributed solar PV systems installed to supply power to a building or other load (dwellings, commercial, and industrial buildings) that is also connected to the utility grid. These systems are increasingly integrated into the built environment and are likely in the future to become commonplace. Typically, for building integrated systems, two different categories occur: A solar PV plant can either be installed on the roof (PV on the roof)—characterized by a higher load factor—or on the facade (solar PV on the facade);

• Off-grid non-domestic systems provide power for a wide range of applications, such as telecommunications, water pumps, vaccine refrigeration, navigation aids, aeronautical warning lights, and meteorological recording equipment. Energy storage is not required, a factor that also improves system efficiency and decreases the environmental impact;

• Grid-connected centralized solar PV systems have been installed for two main purposes: as an alternative to centralized power generation from fossil fuels or nuclear energy or for strengthening of the utility distribution grid.

Most important characteristics with respect to grid-connected solar PV systems are as follows:

• High volatility of the power output due to the strong dependence of the power output on the available sunlight short-term fluctuation as well as a medium- to long-term fluctuations appears;

• High initial investment costs.

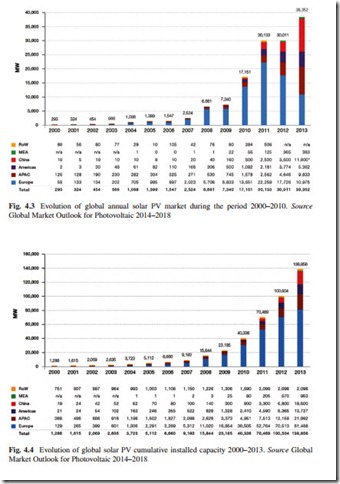

In recent years, the installed capacity of solar PV systems has increased fast.6 In 1990s, annual solar PV production did not exceed 0.1 TWh. Since the turn of the century, both capacity and generation have been growing rapidly. At the end of 2009, the world’s cumulative installed solar PV capacity was more than 23 GW. One year later, it was 40.3 GW, and at the end of 2011, it was 70.5 GW. In 2012, the 100 GW mark was reached, and by 2013, almost 138.9 GW of solar PV had been installed globally—an amount capable of producing at least 160 TWh of electricity every year. This energy volume is sufficient to cover the annual power supply needs of over 45 million European households. This is also the equivalent of the electricity produced by 32 large coal power plants. The global cumulative installed capacity could have even reached 140 GW in 2013, if the additional

1.1 GW in China was taken into account. Europe remains the world’s leading region in terms of cumulative installed solar PV capacity, with 81.5 GW as of 2013. This represents about 59 % of the world’s cumulative solar PV capacity, down from 70 % in 2012 and about 75 % of the world’s capacity in 2011 (Masson et al. 2013).

In Europe, the sector’s rebirth is now being carried onward by Spain, which set an objective of 500 MWe for 2010. For the third year in a row, solar PV in 2013 was among the two most installed sources of electricity in the EU. While wind energy exceeded solar PV in 2013 by some hundreds of MW, these two sources of electricity are the clear leaders of new generation energy sources. Solar PV now covers 3 % of the electricity demand and 6 % of the peak electricity demand in Europe. As the share of solar PV in the electricity mix increases, grid and market integration challenges are becoming more and more important for the future devel- opment of solar PV.

Wiser from the experience obtained from its first three CSP sites located in Almeria, Spain inaugurated its first commercial power plant in Seville in 2006 with 11 MWe and a second plant (Andasol 1) with 50 MW in Grenada. Around additional 700 MWe are on the drawing boards. Spain has had a significant increase in its national market with, according to the Institute for Energy Savings and Diversification (IDAE), “an additional capacity of 14.5 MWe brings Spain’s total installed capacity up to 51.8 MWe.”7 In 2010, Spain regained some ground by installing 370 MW of new solar PV capacity, after two years of strongly adverse conditions.

In France, the sector continues to mobilize actors, even though all of the sites that were developed in the early 1980s have now been converted into research centers. In this way, the National Center of Scientific Research (CNRS) has launched the Pégase Project—a new installation coupled with a gas turbine is going to be erected on the historical site of the Thémis solar tower power plant. Experimentation began in the year 2009, if financing follows. A second project, named “ThemDish,” provides for the installation of five Eurodish parabolas, development by Germany, at the beginning of 2008. France reached, in 2010, over 700 MW of installed solar PV capacity for the generation of electricity. In 2013, an additional 613 MW of PV capacity was installed. This is 45 % less than in the previous year, when 1,115 MW were installed. By the end of 2013, the cumulative solar PV capacity reached almost 4.7 GW. This makes France the seventh biggest producer of solar PV electricity in the world, behind Germany, China, Italy, Japan, the United States and Spain.

After holding the world’s top solar PV market position seven times in the last 14 years, Germany was only the fourth in 2013 with 3.3 GW and yet stills by far the largest European market. The UK was the second European market with

1.5 GW. Italy, which was the second European market in 2012, installed more than 1.4 GW in 2013, down from 3.6 GW the year before and 9.3 GW in 2011. Other European countries that installed more than 1 GW are Romania (around 1.1 GW) and Greece (1.04 GW).

The main problem with the use of this type of energy source for electricity generation in the Netherlands is the high cost of installation even though the government is providing incentives to those who want to use this type of energy source in their private homes for electricity generation.

The Italian decision to increase the participation of solar energy in the country’s energy balance is good news because it will create a big new solar PV market in the coming years racing the current high level of unemployment. However, the Italian population should be made more aware of the importance of using this type of energy source for electricity generation.

The Czech Republic experienced a burst in the use of solar energy for electric- ity generation. In 2010, the country added 1.5 GW of solar PV capacity, but this increase in the use of this technology is unlikely to be sustained in the coming years. In 2010, Belgium connected more than 420 MW of solar PV capacity to the grid. In 2012 the installed capacity expanded to over 2.6 GWp, nearly all of it grid connected. Solar PV produced an estimated 2,115 GWh of electricity in 2012 in Belgium (Observ’ER 2012). In the afternoon of March 20, 2014, a new record of peak electricity generation had been achieved. According to the power supplier Eneco Energie, more than 2 GW of electric power, corresponding to two full-sized nuclear power plants, were generated by solar PV and supplied more than 20 % of the overall electricity consumption at the time (Eneco Energie 2014)

The Situation of the EU Solar Photovoltaic Market

In 2008, the EU-27 solar electricity production totaled 7.4 TWh, but almost all was produced by solar PV systems. EU member states aim to increase solar elec- tricity production of 21 TWh in 2010 to 103 TWh in 2020; this means an increase of 390 %. Between 2010 and 2020, largest additions in solar electricity produc- tion are expected in Germany (41 TWh), Spain (30 TWh), Italy (11 TWh), and France (7 TWh). After a disastrous 2009, the Spanish solar PV market recovered partially, despite adverse conditions, to reach 369 MW. In addition, medium-sized markets progressed in the right direction, with Belgium connecting 424 MW, Greece 150 MW, and Slovakia 145 MW. The UK started to develop solar PV sys- tems in 2010, and while its potential for 2011 may be less than initially expected, it remains one of the most promising solar PV markets in the EU in the short term. Other smaller countries continued their growth, but their relative size (Slovenia and Bulgaria) or overly restrictive local regulations (Austria, Portugal, and Switzerland) made them less important for the development of the solar PV mar- ket as a whole.

According to the Global Market Outlook for PV until 2015 report, in 2010 the EU was the world’s largest solar PV market. With 13.3 GW installed in 2010, its total installed solar PV capacity surged from 16 GW to almost 30 GW. With a production capacity of 30 GW installed in the EU, solar PV generates today over 35 TWh of electricity. Germany continued to represent more than 50 % of it with 7,408 MW installed in 2010, followed by Italy (2,321 MW) and the Czech Republic (1,490 MW). France grew rapidly in 2010, installing 719 MW. Belgium produced a mere 900 kWh per kW of installed capacity every year. Spain produced more than 6.3 TWh of solar PV electricity in the summer with about 3.5 GW installed capacity (the latest installations contributed only marginally to the production in 2010). Italy produced 1.7 TWh last year and France around 0.6 TWh. The largest producer remains Germany with 12 TWh produced in 2010.

Based on these numbers, the production of existing solar power plants should amount, in a complete year, to about 35 TWh for the entire continent. This repre- sents 1.2 % of the EU’s electricity demand. It is expected that around 15–20 TWh could be produced additionally each year until 2015, adding 0.5 or 0.6 % of solar PV to the generation mix in the EU every year. If this rate continues, by 2020, more than 6 % of total demand could be provided by solar PV, according to EPIA. In terms of energy produced (based on expected growth in energy demand), it is

expected that around 40 TWh of additional solar PV production each year will occur in the next ten years. This would mean an average yearly market for solar PV of 35 GW, in comparison with the current annual market of 13 GW.

The prospects of growth in the solar PV market are good. Silicon producers have finally responded to the expectations of the solar PV industry by announcing new production capacities. These extensions have reassured the solar PV industry, which in turn has responded by massively investing in new production capacities, in phase with ever-greater demand. This increase in demand remains, however, dependent upon the political will to develop this market at the national level.

The EU’s share of the global solar PV market remained constant for several years. While Japan was for a long time the clear leader, the EU took prime position when Germany’s market started to grow under the influence of well-designed FiTs. Since then, the EU has retained leadership without much challenge from other markets. Outside the EU, only Japan and the USA have more than 1 GW of installed solar PV capacity. While China could reach that threshold quickly, medium-sized markets will take several years to reach the same level of develop- ment. This will possibly rebalance the solar PV market between the EU and the rest of the world to reflect more closely the patterns in electricity consumption.

From Fig. 4.3, the following can be stated: In 2013, China leads the way, fol- lowed by the EU, Asia–Pacific (APEC) region. North America appears as the fourth region, with Canada develops steadily alongside the USA, a huge market with tremendous potential for growth. Outside these three regions, the Middle East and North Africa region represent untapped potential for the medium term. Solar PV also shows great potential in South America and Africa, where electricity demand will grow significantly in the coming years.

Undoubtedly, Europe is by far the region with the highest accumulative of solar PV in the world with 59 % of the total (see Fig. 4.4). However, with the aim of increasing the use of solar energy for electricity generation in the future, it is important to be aware of the following. According to Alsema et al. (2006), in order to attain a sustainable energy supply system, it is very important that a portfolio of low-carbon energy technologies with a reasonable cost level becomes available as quickly as possible. Most probably, there will finally not be one single best technology, but depending on the local resources (e.g., irradiation), application (e.g., stationary or moving), power demand, and available infrastructure, a choice among available sustainable energy options will be made.

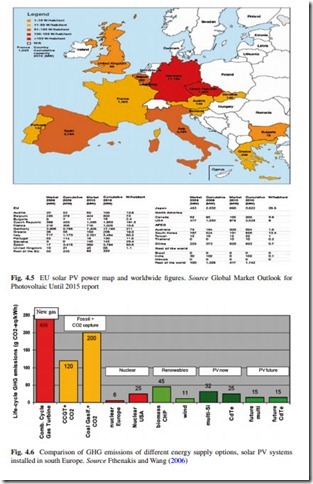

Figure 4.5 shows a solar PV power map. According to that figure, Germany is the European country with the highest accumulative megawatt in solar PV fol- lowed by Spain and Italy Can solar PV technology be considered one of those sustainable energy options? In Fig. 4.6, we have depicted the life cycle greenhouse gas emission of different energy supply options. Among these options, fossil-fueled power plants that are combined with carbon capture and sequestration (CSS) technology was included. Early experiments with CSS have been promising, and there appears to be a sufficiently large potential in underground reservoirs where CO2 can be stored safely for long periods.

If the present-day solar PV technology is compared (at a South European location) with other energy options, it can be seen that solar PV has considerably lower greenhouse gas emissions than all fossil options, including fossil plus CSS. But in comparison with nuclear and wind energy, present-day solar PV has still relatively high greenhouse gas emissions, especially if solar PV systems are installed at lower irradiation regions. On the other hand, it can easily show that there are good prospects for further reduction of the greenhouse gas emissions, down to a comfortable low value of 15 g/kWh. Of course, sustainability comprises more than only low-carbon emissions, it also implies, for example, that no burdens leave for future generations, and in this respect, solar PV technology appears to have a better profile than, for example, nuclear energy or fossil fuel with CSS, pro- vided that solar PV technology is able to close the material loops by developing effective recycling processes. Also, it is important to know that solar PV has a very large potential for application, larger than wind energy and probably also larger than nuclear and carbon storage.

Finally, it is important to highlight the following: Economic uncertainty in several European countries has in some cases led policy makers to make decisions that have a negative effect on the solar PV market, such as imposing retrospective measures.

These decisions severely erode investor confidence, even as solar PV technology and competitiveness improve slowing market development in a way that is not easily predictable. In 2013, several retrospective measures were taken, severely damaging the reputation of solar PV. Moreover, such measures harm the credibility of the countries beyond solar PV, affecting their whole financial sector (Masson et al. 2013).